Recently, the storage company Micron issued a warning message saying that PC customers are facing shortages of other parts, which has led to a decrease in the amount of storage they are pulling. Affected by this, Micron's revenue and net profit levels are expected to be lower than market expectations.

In the context of the global core shortage, almost all major semiconductor companies have achieved good revenue, either because of the surge in demand or because of higher prices, and Micron is almost the first indicator that its performance is not up to expectations. Dachang.

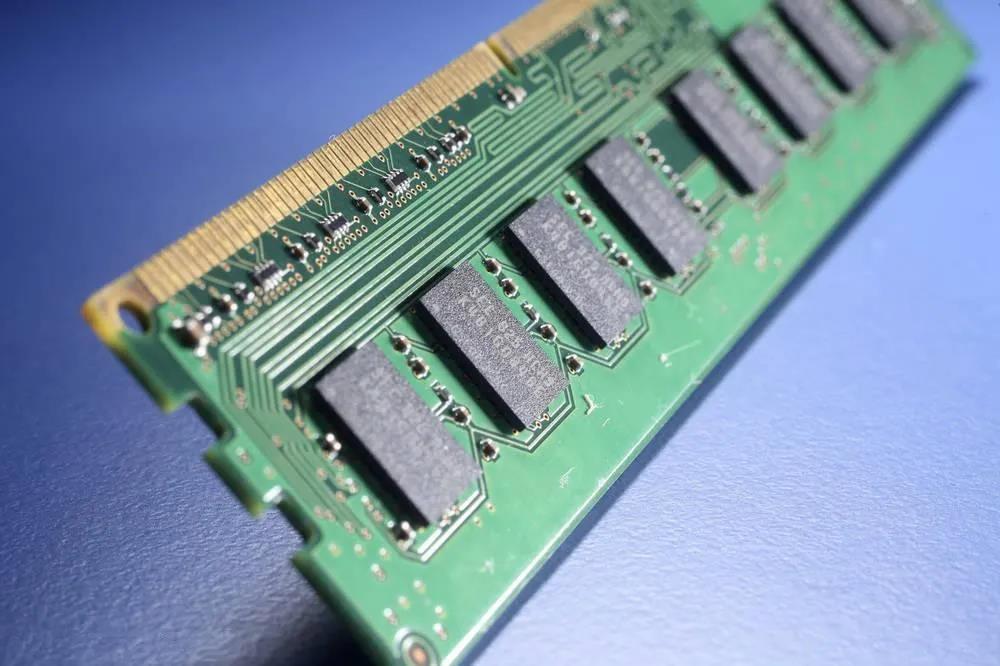

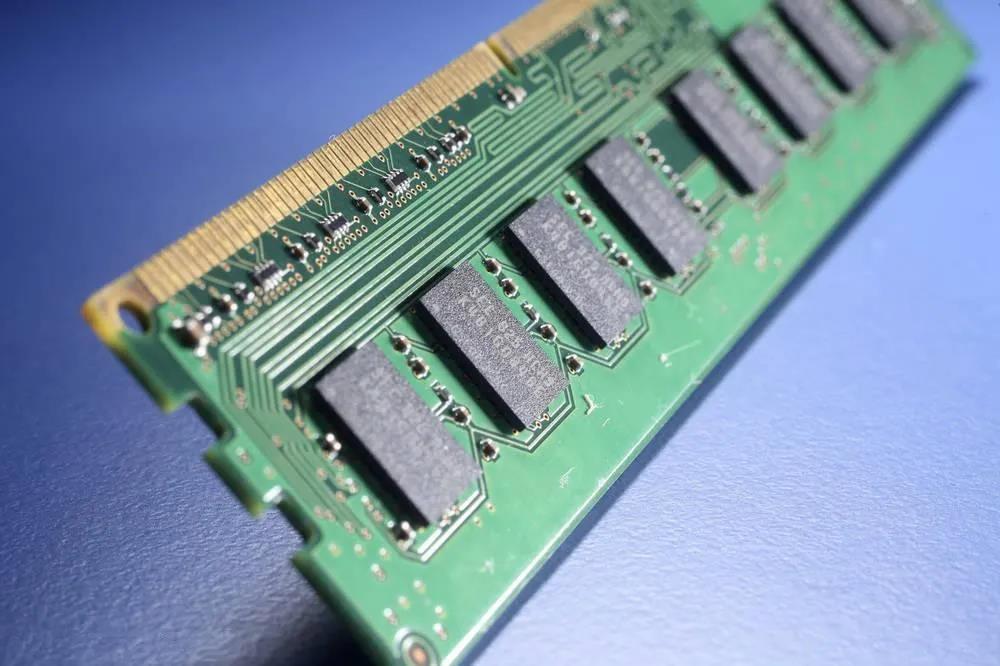

DRAM development trajectory

The cycle of DRAM products has always been special. The biggest influencing factor in the industry is probably the expansion of several major storage manufacturers and unexpected conditions in factories. Usually, after Samsung, SK Hynix and Micron have invested heavily for a period of time, there will be a period of oversupply in the DRAM field; and when a fire or special gas leakage occurs in an important factory of several major manufacturers, the price of the product will be lower. Will rise in response.

Here we briefly review the situation from 2017 to 2019. There are very obvious traces of events. In 2017, as the world's largest memory manufacturer, Samsung Electronics' wafer fab suffered a very serious power outage, resulting in scrapped memory and flash memory wafers. According to statistics at the time, the total scrap output for half an hour of power outage was equivalent to 11% of Samsung's and 3.5% of the world's.

Affected by this incident, global memory prices have skyrocketed. In 2017, memory was dubbed by the industry as "the world's best financial product." In 2016, the average consumer bought an 8GB memory stick at a price of more than 100 yuan, but in 2017, the price was close to 1,000 yuan. In this year, the price increase of memory sticks outperformed the Chinese property market. The second half of 2016 and 2017 were the time when the Chinese property market skyrocketed, but the popularity of memory overwhelmed the property market.

Obviously, this kind of price fluctuation reflects the status of storage head manufacturers in the industry, and it can be said to affect the whole body. According to relevant statistics, in 2017, Samsung, SK Hynix and Micron accounted for more than 95% of the market in the field of memory particles, of which Samsung accounted for about 45%. With such a market share, Samsung's supply problems will inevitably cause market supply to fall short of demand. However, Samsung not only did not affect revenue due to the accident, but its net profit broke the historical record.

By 2018, the unified action of the three major manufacturers is to increase production capacity. Samsung opened the world's largest flash memory plant in 2018, greatly increasing its production capacity; Micron continued to spend US$2 billion to expand production after acquiring Huayaco; SK Hynix's Wuxi plant smoothly increased production, with an investment of US$8.6 billion in the plant.

The result is obvious, the global market has begun to experience overcapacity of memory. At the beginning of 2019, the contract price of 8Gb DDR4 memory chips was around US$6.13. By the end of the year, it quickly dropped to a freezing point of only US$2.79~2.88. The price of memory has plummeted by more than 50%. However, the three major manufacturers are definitely unwilling to see such a situation and have reduced production and investment in 2019.

As a result, we saw in 2020 Q1 that the contract price of memory has increased by 10% to 20%.

The new round of market trends is not controlled by memory manufacturers

Entering 2021, the global market will gradually recover under the suppression of the 2020 epidemic, and this is true for smartphones, automobiles, and industries. At the same time, the epidemic has changed people's lives and office patterns, and the housing economy has become a new industry hotspot. Under such circumstances, the demand for memory in various fields is rapidly expanding.

According to related reports, even if global memory prices show a steady upward trend in 2020, the profits of the major memory factories in the first five months of 2021 will be more than the full year of 2020. Previously, both manufacturers and industry experts believed that in 2021, memory will have a boom market that will last for one year.

However, at this time, the memory industry is no longer an industry entirely dominated by industry leaders, and external factors have played a more important role. At present, the main theme of the global semiconductor market is the chip supply crisis, and its impact is not shifted by the will of the head manufacturers.

According to previous reports, market sources revealed that due to sharp fluctuations in spot prices, DRAM contract prices will fall more than expected in the fourth quarter of 2021. According to TrendForce's forecast, the overall average DRAM price in the fourth quarter fell by 3% to 8%.

According to comprehensive industry information, DRAM inventory remains at a high level, and shipment channels are severely limited by the shortage of other chips.

In terms of applications, the top two markets for memory applications are PCs and smartphones. However, due to the severe shortage of chips in the automotive industry, foundries have transferred a considerable part of their production capacity to the field of automotive chips. At the same time, IDM manufacturers are adjusting their product supply. Infineon, ON Semiconductor, Wingtech, Silan Micro and other manufacturers have reduced the output of low-voltage MOSFETs for consumer electronics, and switched to higher-margin automotive high-voltage MOSFETs. As a result, the shipment of components on the PC is insufficient.

Before Micron, many financial institutions have made negative judgments on the DRAM market, and the quotations are expected to weaken. Micron itself also expects that its revenue for the quarter ending at the end of November will be approximately US$7.65 billion, which is far below the US$8.57 billion predicted by analysts.

IDM manufacturer insiders revealed that the current market strategy will be relatively clear until the first half of 2022. The main production capacity will be concentrated in the automotive market. Low-voltage MOSFET products are expected to be in short supply, resulting in prices remaining at a relatively high level. Manufacturers have also foreseen this situation and are looking for external capacity to help produce low-voltage MOSFETs. However, when the world's major fabs are fully loaded, it is expected that more capacity support will not be available until the second half of 2022.

Therefore, for DRAM products, the next three quarters are expected to be economic winter.

.

PCB Assembly

PCB Assembly

Layer Buildup

Layer Buildup

Online Tools

Online Tools

PCB Design-Aid & Layout

PCB Design-Aid & Layout

Mechanics

Mechanics

SMD-Stencils

SMD-Stencils

Quality

Quality

Drills & Throughplating

Drills & Throughplating

Factory & Certificate

Factory & Certificate

PCB Assembly Factory Show

Certificate

PCB Assembly Factory Show

Certificate